Transportation expenses for Mason business travel are generally reimbursable subject to the criteria specified in University Policy 2101.

Travelers are required to obtain original receipts for all transportation expenses in excess of $75. Receipts must be uploaded and attached to the corresponding travel document in order to be reimbursed to the traveler. Original documentation/receipts should be retained by the traveler until after reimbursement has been received. The Travel Office may request original receipts if the uploaded document is illegible. For additional information please see the Submit Receipts Guide. Please note that Mason Finance Gateway is currently used for reimbursements only. If your Pre-Approval includes P-card purchases, or are otherwise not reimbursable, you must delete those line items from the Expense report.

Although receipts for actual transportation costs under $75 are generally not required, if the maximum reimbursable amount is claimed on a consistent basis, the Travel Office may require receipts to be presented.

Unallowable Expenses

The following is a list of common expenses that are not reimbursable. It is NOT all-inclusive.

- Damage to personal vehicles

- Expenses related to personal negligence of the traveler, such as fines

- Services to gain entry to locked vehicles

- Towing charges

- Insurance associated with rental cars in the United States

- Luxury vehicle rentals

- Excessive parking and gasoline charges

- University parking fees

- Local commuting expenses

- Travel between lodging and places where meals may be taken

Other Transportation-related receipts that may be required include the following:

- Public transportation receipts– taxi, limo, etc.

- Rental car, including gasoline receipts

- Parking and toll charges

Air and Rail Travel

Generally, airline travel cannot exceed the lowest rates charged for nonrefundable tourist/coach fare with a reasonable number of stops given the distance traveled. Justification is required for the purchase of refundable tickets. Some airlines have created a higher level of coach class services that charge a premium for preferable seats, priority boarding, advance seat selection, and/or other amenities. Such upgrades in the coach seating area are considered enhancements to the coach fare and are not reimbursable. For examples of what to consider when purchasing tickets please review the Flight Comparison Example guide.

Some airlines charge additional fees for services, such as checked baggage, previously included in the ticket price. These fees are reimbursable, with a receipt, when limits must be exceeded for legitimate business purposes. Written justification must be provided when requesting reimbursement for two or more checked bags.

A traveler’s Authorized Approver/Supervisor may approve business class travel under the following circumstances:

Airfare Exceptions

- The business class fare does not cost more than the lowest available tourist/coach fare (a comparison must be provided showing the business and coach class fares)

- The travel is to Western Europe and the business meeting is conducted within three hours of landing

- The travel is for a transoceanic intercontinental trip of more than eight hours

- The traveler pays the difference.

- First-class travel is not allowable.

Rail Exceptions

- The business class fare does not cost more than the lowest available tourist/coach fare (comparison must be attached to travel voucher)

- Reserved coach seats are not offered on the route

- The traveler pays the difference.

All tickets or receipts must indicate coach class fares unless appropriate documentation is obtained. Reimbursement for first-class travel, including Acela service, is prohibited.

Fly America Act

When federal funds are used, provisions of the Fly America Act are applicable and foreign travel is restricted to a U.S. air carrier unless extenuating circumstances apply or there is an Open Skies agreement.

Additional information on the Fly America Act is available on the Award Requirements page of the Office of Sponsored Programs website.

Reserve and Pay for Airfare

The procurement of Travel services through the Internet is permitted. Travelers should use caution and prudent judgment when choosing an Internet travel service site. Hidden fees, significant prepayments, or non-refundable advances may apply that may not be reimbursable. When travel services are procured via the Internet, the following supplemental documentation must be uploaded and attached to the Mason Finance Gateway.

- All pages of the confirmation document generated when the internet reservation is complete show the total cost and class of service (e.g. coach, business class) for electronic tickets.

- Passenger receipt (ticket stub) when a paper ticket is issued.

The following payment methods may be used:

- Travel Charge Card (Individual Liability)- may be used for all types of purchases (i.e., hotel, transportation, etc.) The full Travel Charge Card balance is paid by the traveler on a monthly basis regardless of reimbursement status.

- P-Card – may ONLY be used for transportation tickets (airline, rail) to the primary destination. May not be used for local travel such as shuttle, metro, or taxi.

- Personal Credit Card – may be used for all types of purchases. Reimbursement is requested after the trip is completed. In many cases, a Travel Authorization must be completed before the trip to authorize using state funds.

Information on Mason travel service providers is available on the Book Travel Online webpage.

Trip Cancellation

Trip cancellation or travel protection insurance is not a reimbursable expense. Travelers should utilize the P-Card to purchase air or rail tickets to avoid out-of-pocket expenses. If the trip is canceled after airline tickets have been purchased, travelers may be reimbursed with their supervisor’s approval. The approval must include a statement by the supervisor noting that they agree to monitor the future use of the ticket.

- The business class fare does not cost more than the lowest available tourist/coach fare (a comparison must be provided showing the business and coach class fares)

- The travel is to Western Europe and the business meeting is conducted within three hours of landing

- The travel is for a transoceanic intercontinental trip of more than eight hours

- The traveler pays the difference.

- First-class travel is not allowable.

Rail Exceptions

- The business class fare does not cost more than the lowest available tourist/coach fare (comparison must be attached to travel voucher)

- Reserved coach seats are not offered on the route

- The traveler pays the difference.

All tickets or receipts must indicate coach class fares unless appropriate documentation is obtained. Reimbursement for first-class travel, including Acela service, is prohibited.

Fly America Act

When federal funds are used, provisions of the Fly America Act are applicable and foreign travel is restricted to a U.S. air carrier unless extenuating circumstances apply or there is an Open Skies agreement.

Additional information on the Fly America Act is available on the Award Requirements page of the Office of Sponsored Programs website.

Reserve and Pay for Airfare

The procurement of Travel services through the Internet is permitted. Travelers should use caution and prudent judgment when choosing an Internet travel service site. Hidden fees, significant prepayments, or non-refundable advances may apply that may not be reimbursable. When travel services are procured via the Internet, the following supplemental documentation must be uploaded and attached to the Mason Finance Gateway.

- All pages of the confirmation document generated when the internet reservation is complete show the total cost and class of service (e.g. coach, business class) for electronic tickets.

- Passenger receipt (ticket stub) when a paper ticket is issued.

The following payment methods may be used:

- Travel Charge Card (Individual Liability)- may be used for all types of purchases (i.e., hotel, transportation, etc.) The full Travel Charge Card balance is paid by the traveler on a monthly basis regardless of reimbursement status.

- P-Card – may ONLY be used for transportation tickets (airline, rail) to the primary destination. May not be used for local travel such as shuttle, metro, or taxi.

- Personal Credit Card – may be used for all types of purchases. Reimbursement is requested after the trip is completed. In many cases, a Travel Authorization must be completed before the trip to authorize using state funds.

Information on Mason travel service providers is available on the Book Travel Online webpage.

Trip Cancellation

Trip cancellation or travel protection insurance is not a reimbursable expense. Travelers should utilize the P-Card to purchase air or rail tickets to avoid out-of-pocket expenses. If the trip is canceled after airline tickets have been purchased, travelers may be reimbursed with their supervisor’s approval. The approval must include a statement by the supervisor noting that they agree to monitor the future use of the ticket.

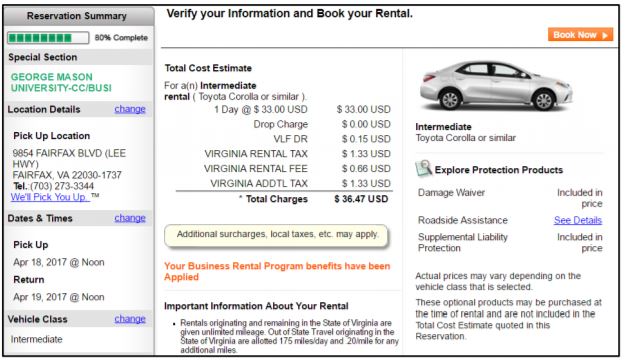

Vehicle Travel

Business travel must be conducted by the most economical means. Therefore, the Virginia Office of Fleet Management Services has partnered with Enterprise Rent-a-Car to provide short-term rental cars for state agencies. Reimbursement may be made for rental car costs and gas purchases. Reimbursements for fuel are limited to prices at customary, competitive outlets. In no instance should the traveler enter into a “Fuel Agreement” or pay for fuel in advance when renting a vehicle. In cases where the use of a personal vehicle is most economical, reimbursements are made on a per-mile basis. Additional information is available below.

Reimbursement may be received for rental of a compact, economy, mid-size class or standard cars when circumstances warrant. Luxury vehicle rentals will not be reimbursed. No reimbursement is authorized for vehicle rentals from non-traditional sources or for informal vehicle rentals from friends, colleagues or relatives. Peer-to-peer car sharing sites (i.e., Turo, GetAround, HyreCare, etc.) require advance approval from the Travel Department prior to booking.

Motor Pool Vehicles

State contract Enterprise rates will be applied for any trips processed through Motor Pool.

Motor Pool will make payment to Enterprise on your behalf and debit your department/organization through the University chargeback process. Motor Pool will also provide you with a University fuel card for use with your Enterprise rental during official travel.

You may also schedule and rent a vehicle on the State contract directly with Enterprise without assistance from Motor Pool. If you choose this option, you will be asked to present payment (option of paying with a University Travel Card or personal funds for reimbursement) when picking up the vehicle. Please note: a University fuel card will not be issued.

Additional information is available on the Motor Pool web page.

Enterprise Trip Calculator

Travelers must access the Enterprise Trip Calculator at Trip Calculator when planning a trip that involves traveling more than 280 miles per day. In most cases, a traveler will be reimbursed for the cost of an Enterprise rental vehicle and gas OR mileage at the fleet rate. The Enterprise Guide provides instructions for Enterprise Trip Calculator.

Click here for Enterprise Reservations login with your Mason Single Sign-On (SSO) to view.

Vehicle Driven Trip Calculator:

Enterprise Lower Cost Enterprise Vehicle Available Reimbursement

Enterprise Yes Yes Rental and gas

Personal Yes Yes Mileage @ fleet rate

Personal Yes No** Mileage @ personal rate

Personal No N/A Mileage @ personal rate

Personal Calculator not attached N/A Mileage @ fleet rate

Motor Pool N/A N/A $0 (recharge to Dept.)

*At least 24 hours before a trip, the Enterprise Trip Calculator should be accessed at Trip Calculator. The cost Comparison page must be printed and attached to the Travel Reimbursement Voucher.

**Page indicating vehicle not available on a specific date(s) must be printed and attached to the Travel Reimbursement Voucher.

The number of days to be entered in the calculator will be the number of 24-hour car rental days necessary for the trip. If the Enterprise location is open Monday-Friday from 7:30 a.m. to 6 p.m., it may be necessary to pick up or return a car a day before and/or after the trip.

Adjustments to Enterprise Calculator

The Enterprise calculator assumes the rental of a compact vehicle in computing the Enterprise Vehicle cost. Since this Excel document is “protected” at the state level, Mason users are not permitted to make any electronic changes to rates or calculations. Thus in some circumstances, it may be necessary to make written changes to the amounts generated by the calculator for purposes of determining the lowest cost of transportation.

In the following situations, the Enterprise calculator should be printed and an adjustment should be written on the Lowest Cost Transportation line of the calculator page.

- The Proposed Driver is Younger than Age 21. The Enterprise contract requires that the driver be 21 years of age or older. If the traveler is under 21, write “driver is younger than age 21” on the Lowest Cost Transportation line. Reimbursement will be at the personal mileage rate.

Insurance on Rental Vehicles

Employees

The Commonwealth provides a statewide self-insured plan for employees. Therefore, employees will not be reimbursed for rental car insurance for locations within the United States, and employees should decline liability damage waiver (LDW) and collision damage waiver (CDW) insurance for travel within the United States. Other forms of insurance such as personal accident insurance (PAI) are also not reimbursable.

Non-employees

A Traveler who is not a state employee should determine whether their personal automobile insurance provides coverage on rental vehicles. Reimbursement for insurance charges will only be made for those individuals without such coverage.

Foreign Travel

All travelers in foreign countries must purchase appropriate insurance and will be reimbursed for all reasonable, necessary, and actual insurance premiums.

Personal Vehicles

Travelers may be reimbursed for the use of a personal vehicle while traveling on university business. Since the state requires that travel be conducted in the most economical manner, total reimbursement for vehicle use, lodging, meals, and incidental expenses may not exceed the alternative cost of travel by the most economical air routing.

Mileage Rates

An employee will normally be reimbursed at the fleet rate, currently $0.246 per mile when they drive a personal vehicle more than 280 miles per day for business-related travel. Travelers may be reimbursed at the personal mileage rate (available at https://www.irs.gov/tax-professionals/standard-mileage-rates), in the following situations:

- The mileage does not exceed 280 miles per day.

- The mileage per day is more than 280 miles, but the cost of the personal car does not exceed the cost of an Enterprise vehicle.*

- An Enterprise rental vehicle is not available.**

- The proposed driver is younger than 21 years of age.

*The traveler must attach the Enterprise Trip Calculator Form to the Travel Reimbursement Voucher.

**The traveler must print a copy of the Enterprise page indicating the vehicle is sold out for the day(s) requested and attach it to the Travel Reimbursement Voucher.

Commuter Mileage

Round-trip mileage traveled routinely and directly by an employee between his residence and workplace incurred on a workday is considered commuting mileage. Commuting mileage and other commuting costs incurred on workdays are considered personal expenses and are not reimbursable.

Shuttle, Taxi, Parking, and Tolls

Reimbursement is provided for parking fees and toll charges incurred. Parking on George Mason University property is not reimbursable. Parking at airports is limited to the most economical rate.

Reimbursement is provided for taxi and shuttle van fares between airports or other transportation terminals and hotels or other lodging facilities. Receipts are required when the reimbursement claim exceeds $75. A maximum tip of 15% of the taxicab or shuttle service fare is reimbursable as a transportation cost separate from Meals and Incidental Expenses. The amount of the tip should be separated from the fare on the Travel Reimbursement Voucher.

Local Area Transportation

Non-commuting travel expenses may be reimbursed when individuals must travel in the local area on official business. This includes trips between university campuses or to other locations in the vicinity to attend meetings or training classes, to deliver paperwork, etc. Travel may be by personal vehicle or local common carrier (e.g., metro, bus, etc.)

To minimize transaction processing costs, please consider claiming reimbursement only once a month or whenever total mileage exceeds 100 miles.

Reimbursable Local Transportation Expenses

- Non-commuting travel expenses on official business

- Commercial parking fees and toll charges

Non-Reimbursable Local Transportation Expenses

- Charges to park on Mason property (i.e., University decals, passes, and parking meters) are not reimbursable

- Normal commuting mileage; only the net additional mileage may be claimed

Example:

An employee, whose normal work location is the Fairfax campus, has a normal round-trip commute of 20 miles. On a scheduled workday she travels 30 miles from her residence to the Prince William campus to conduct training. The training concludes at 10:00 a.m. when the employee travels 20 miles from Prince William to her office in Fairfax. The employee travels 6 miles round trip for lunch and returns to work.

In the afternoon she travels 15 miles to the Arlington campus for a meeting, after which she travels 12 miles to her residence. The total distance traveled is 83 miles (30+20+6+15+12). The total reimbursable mileage is 57 miles (83-26) excluding normal commuting (20 miles) and personal (6 miles) mileage.

For Questions please contact us at mfgadmin@gmu.edu.

Business travel must be conducted by the most economical means. Therefore, the Virginia Office of Fleet Management Services has partnered with Enterprise Rent-a-Car to provide short-term rental cars for state agencies. Reimbursement may be made for rental car costs and gas purchases. Reimbursements for fuel are limited to prices at customary, competitive outlets. In no instance should the traveler enter into a “Fuel Agreement” or pay for fuel in advance when renting a vehicle. In cases where the use of a personal vehicle is most economical, reimbursements are made on a per-mile basis. Additional information is available below.

Reimbursement may be received for rental of a compact, economy, mid-size class or standard cars when circumstances warrant. Luxury vehicle rentals will not be reimbursed. No reimbursement is authorized for vehicle rentals from non-traditional sources or for informal vehicle rentals from friends, colleagues or relatives. Peer-to-peer car sharing sites (i.e., Turo, GetAround, HyreCare, etc.) require advance approval from the Travel Department prior to booking.

Motor Pool Vehicles

State contract Enterprise rates will be applied for any trips processed through Motor Pool.

Motor Pool will make payment to Enterprise on your behalf and debit your department/organization through the University chargeback process. Motor Pool will also provide you with a University fuel card for use with your Enterprise rental during official travel.

You may also schedule and rent a vehicle on the State contract directly with Enterprise without assistance from Motor Pool. If you choose this option, you will be asked to present payment (option of paying with a University Travel Card or personal funds for reimbursement) when picking up the vehicle. Please note: a University fuel card will not be issued.

Additional information is available on the Motor Pool web page.

Enterprise Trip Calculator

Travelers must access the Enterprise Trip Calculator at Trip Calculator when planning a trip that involves traveling more than 280 miles per day. In most cases, a traveler will be reimbursed for the cost of an Enterprise rental vehicle and gas OR mileage at the fleet rate. The Enterprise Guide provides instructions for Enterprise Trip Calculator.

Click here for Enterprise Reservations login with your Mason Single Sign-On (SSO) to view.

Vehicle Driven Trip Calculator:

Enterprise Lower Cost Enterprise Vehicle Available Reimbursement

Enterprise Yes Yes Rental and gas

Personal Yes Yes Mileage @ fleet rate

Personal Yes No** Mileage @ personal rate

Personal No N/A Mileage @ personal rate

Personal Calculator not attached N/A Mileage @ fleet rate

Motor Pool N/A N/A $0 (recharge to Dept.)

*At least 24 hours before a trip, the Enterprise Trip Calculator should be accessed at Trip Calculator. The cost Comparison page must be printed and attached to the Travel Reimbursement Voucher.

**Page indicating vehicle not available on a specific date(s) must be printed and attached to the Travel Reimbursement Voucher.

The number of days to be entered in the calculator will be the number of 24-hour car rental days necessary for the trip. If the Enterprise location is open Monday-Friday from 7:30 a.m. to 6 p.m., it may be necessary to pick up or return a car a day before and/or after the trip.

Adjustments to Enterprise Calculator

The Enterprise calculator assumes the rental of a compact vehicle in computing the Enterprise Vehicle cost. Since this Excel document is “protected” at the state level, Mason users are not permitted to make any electronic changes to rates or calculations. Thus in some circumstances, it may be necessary to make written changes to the amounts generated by the calculator for purposes of determining the lowest cost of transportation.

In the following situations, the Enterprise calculator should be printed and an adjustment should be written on the Lowest Cost Transportation line of the calculator page.

- The Proposed Driver is Younger than Age 21. The Enterprise contract requires that the driver be 21 years of age or older. If the traveler is under 21, write “driver is younger than age 21” on the Lowest Cost Transportation line. Reimbursement will be at the personal mileage rate.

Insurance on Rental Vehicles

Employees

The Commonwealth provides a statewide self-insured plan for employees. Therefore, employees will not be reimbursed for rental car insurance for locations within the United States, and employees should decline liability damage waiver (LDW) and collision damage waiver (CDW) insurance for travel within the United States. Other forms of insurance such as personal accident insurance (PAI) are also not reimbursable.

Non-employees

A Traveler who is not a state employee should determine whether their personal automobile insurance provides coverage on rental vehicles. Reimbursement for insurance charges will only be made for those individuals without such coverage.

Foreign Travel

All travelers in foreign countries must purchase appropriate insurance and will be reimbursed for all reasonable, necessary, and actual insurance premiums.

Personal Vehicles

Travelers may be reimbursed for the use of a personal vehicle while traveling on university business. Since the state requires that travel be conducted in the most economical manner, total reimbursement for vehicle use, lodging, meals, and incidental expenses may not exceed the alternative cost of travel by the most economical air routing.

Mileage Rates

An employee will normally be reimbursed at the fleet rate, currently $0.246 per mile when they drive a personal vehicle more than 280 miles per day for business-related travel. Travelers may be reimbursed at the personal mileage rate (available at https://www.irs.gov/tax-professionals/standard-mileage-rates), in the following situations:

- The mileage does not exceed 280 miles per day.

- The mileage per day is more than 280 miles, but the cost of the personal car does not exceed the cost of an Enterprise vehicle.*

- An Enterprise rental vehicle is not available.**

- The proposed driver is younger than 21 years of age.

*The traveler must attach the Enterprise Trip Calculator Form to the Travel Reimbursement Voucher.

**The traveler must print a copy of the Enterprise page indicating the vehicle is sold out for the day(s) requested and attach it to the Travel Reimbursement Voucher.

Commuter Mileage

Round-trip mileage traveled routinely and directly by an employee between his residence and workplace incurred on a workday is considered commuting mileage. Commuting mileage and other commuting costs incurred on workdays are considered personal expenses and are not reimbursable.

Travelers must access the Enterprise Trip Calculator at Trip Calculator when planning a trip that involves traveling more than 280 miles per day. In most cases, a traveler will be reimbursed for the cost of an Enterprise rental vehicle and gas OR mileage at the fleet rate. The Enterprise Guide provides instructions for Enterprise Trip Calculator.

Click here for Enterprise Reservations login with your Mason Single Sign-On (SSO) to view.

Enterprise Lower Cost | |||

|---|---|---|---|

| Enterprise | Yes | Yes | Rental and gas |

| Personal | Yes | Yes | Mileage @ fleet rate |

| Personal | Yes | No** | Mileage @ personal rate |

| Personal | No | N/A | Mileage @ personal rate |

| Personal | Calculator not attached | N/A | Mileage @ fleet rate |

| Motor Pool | N/A | N/A | $0 (recharge to Dept.) |

*At least 24 hours before a trip, the Enterprise Trip Calculator should be accessed at Trip Calculator. The cost Comparison page must be printed and attached to the Travel Reimbursement Voucher.

**Page indicating vehicle not available on a specific date(s) must be printed and attached to the Travel Reimbursement Voucher.

The number of days to be entered in the calculator will be the number of 24-hour car rental days necessary for the trip. If the Enterprise location is open Monday-Friday from 7:30 a.m. to 6 p.m., it may be necessary to pick up or return a car a day before and/or after the trip.

Adjustments to Enterprise Calculator

The Enterprise calculator assumes the rental of a compact vehicle in computing the Enterprise Vehicle cost. Since this Excel document is “protected” at the state level, Mason users are not permitted to make any electronic changes to rates or calculations. Thus in some circumstances, it may be necessary to make written changes to the amounts generated by the calculator for purposes of determining the lowest cost of transportation.

In the following situations, the Enterprise calculator should be printed and an adjustment should be written on the Lowest Cost Transportation line of the calculator page.

- The Proposed Driver is Younger than Age 21. The Enterprise contract requires that the driver be 21 years of age or older. If the traveler is under 21, write “driver is younger than age 21” on the Lowest Cost Transportation line. Reimbursement will be at the personal mileage rate.

Employees

The Commonwealth provides a statewide self-insured plan for employees. Therefore, employees will not be reimbursed for rental car insurance for locations within the United States, and employees should decline liability damage waiver (LDW) and collision damage waiver (CDW) insurance for travel within the United States. Other forms of insurance such as personal accident insurance (PAI) are also not reimbursable.

Non-employees

A Traveler who is not a state employee should determine whether their personal automobile insurance provides coverage on rental vehicles. Reimbursement for insurance charges will only be made for those individuals without such coverage.

Foreign Travel

All travelers in foreign countries must purchase appropriate insurance and will be reimbursed for all reasonable, necessary, and actual insurance premiums.

Travelers may be reimbursed for the use of a personal vehicle while traveling on university business. Since the state requires that travel be conducted in the most economical manner, total reimbursement for vehicle use, lodging, meals, and incidental expenses may not exceed the alternative cost of travel by the most economical air routing.

Mileage Rates

An employee will normally be reimbursed at the fleet rate, currently $0.246 per mile when they drive a personal vehicle more than 280 miles per day for business-related travel. Travelers may be reimbursed at the personal mileage rate (available at https://www.irs.gov/tax-professionals/standard-mileage-rates), in the following situations:

- The mileage does not exceed 280 miles per day.

- The mileage per day is more than 280 miles, but the cost of the personal car does not exceed the cost of an Enterprise vehicle.*

- An Enterprise rental vehicle is not available.**

- The proposed driver is younger than 21 years of age.

*The traveler must attach the Enterprise Trip Calculator Form to the Travel Reimbursement Voucher.

**The traveler must print a copy of the Enterprise page indicating the vehicle is sold out for the day(s) requested and attach it to the Travel Reimbursement Voucher.

Commuter Mileage

Round-trip mileage traveled routinely and directly by an employee between his residence and workplace incurred on a workday is considered commuting mileage. Commuting mileage and other commuting costs incurred on workdays are considered personal expenses and are not reimbursable.

Reimbursement is provided for parking fees and toll charges incurred. Parking on George Mason University property is not reimbursable. Parking at airports is limited to the most economical rate.

Reimbursement is provided for taxi and shuttle van fares between airports or other transportation terminals and hotels or other lodging facilities. Receipts are required when the reimbursement claim exceeds $75. A maximum tip of 15% of the taxicab or shuttle service fare is reimbursable as a transportation cost separate from Meals and Incidental Expenses. The amount of the tip should be separated from the fare on the Travel Reimbursement Voucher.

Non-commuting travel expenses may be reimbursed when individuals must travel in the local area on official business. This includes trips between university campuses or to other locations in the vicinity to attend meetings or training classes, to deliver paperwork, etc. Travel may be by personal vehicle or local common carrier (e.g., metro, bus, etc.)

To minimize transaction processing costs, please consider claiming reimbursement only once a month or whenever total mileage exceeds 100 miles.

Reimbursable Local Transportation Expenses

- Non-commuting travel expenses on official business

- Commercial parking fees and toll charges

Non-Reimbursable Local Transportation Expenses

- Charges to park on Mason property (i.e., University decals, passes, and parking meters) are not reimbursable

- Normal commuting mileage; only the net additional mileage may be claimed

Example:

An employee, whose normal work location is the Fairfax campus, has a normal round-trip commute of 20 miles. On a scheduled workday she travels 30 miles from her residence to the Prince William campus to conduct training. The training concludes at 10:00 a.m. when the employee travels 20 miles from Prince William to her office in Fairfax. The employee travels 6 miles round trip for lunch and returns to work.

In the afternoon she travels 15 miles to the Arlington campus for a meeting, after which she travels 12 miles to her residence. The total distance traveled is 83 miles (30+20+6+15+12). The total reimbursable mileage is 57 miles (83-26) excluding normal commuting (20 miles) and personal (6 miles) mileage.

- Non-commuting travel expenses on official business

- Commercial parking fees and toll charges

Non-Reimbursable Local Transportation Expenses

- Charges to park on Mason property (i.e., University decals, passes, and parking meters) are not reimbursable

- Normal commuting mileage; only the net additional mileage may be claimed

Example:

An employee, whose normal work location is the Fairfax campus, has a normal round-trip commute of 20 miles. On a scheduled workday she travels 30 miles from her residence to the Prince William campus to conduct training. The training concludes at 10:00 a.m. when the employee travels 20 miles from Prince William to her office in Fairfax. The employee travels 6 miles round trip for lunch and returns to work.

In the afternoon she travels 15 miles to the Arlington campus for a meeting, after which she travels 12 miles to her residence. The total distance traveled is 83 miles (30+20+6+15+12). The total reimbursable mileage is 57 miles (83-26) excluding normal commuting (20 miles) and personal (6 miles) mileage.